(Previous Topic: Setting Up Group Types)

Mapping Sales Information

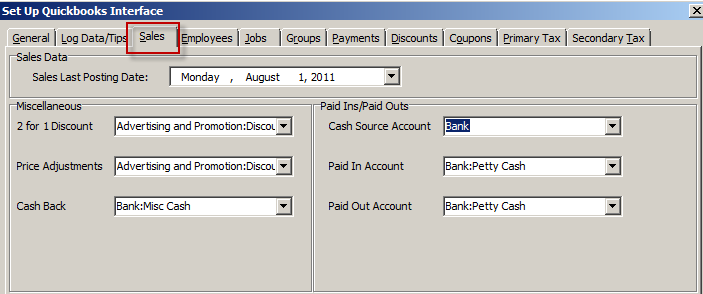

The Sales tab under the Setup Form provides for setting up of the sales data related options.

If you are going to be using the interface in sending Restaurant Manager sales data to QuickBooks, the Groups, Payments, Payments, Discounts, Primary Tax and Secondary Tax tabs would need to be set-up too.

Sales Last Posting Date

This function is performed under the Sales Tab. Use the Sales Last Posting function to tell the interface (POSQBi) the last sales date that was successfully sent to QuickBooks. Doing so serves as the basis when retrieving Restaurant Manager (RMPOS) sales data and in providing a warning to the user in case there is a possibility of double posting.

Miscellaneous Sales Settings

The following options under the Miscellaneous group should also be assigned with the proper accounts when being sent to QuickBooks as a General Journal entry:

2 for 1 Discount – the account to use when sending to QuickBooks for recording expenses incurred for sales that are 2 for 1 discounted. Normally, this QuickBooks account type would be an Expense or Other Expense.

Price Adjustment – the account to use when sending to QuickBooks for recording price adjustments. It is assumed that price adjustments would be done as a fixed amount discounting, if so, the entry would be a debit line to an Expense or Other Expense account. However, if the price adjustment increases the sale amount, then a credit line to the same account.

Cash Back – the account determined to be the fund source when giving cash back specially for transactions paid by a debit card. Normally, the QuickBooks account type would be Bank.

The following options under the “Paid Ins/Out ” group should also be assigned with the proper accounts when being sent to QuickBooks as a General Journal entry:

Cash Source Account-Use the drop down menu to map the cash source account in QuickBooks used for Paid In/Out

Paid In Account- Use the drop down menu to map the cash source account in QuickBooks used for Paid Ins. This may be a "other income" account or sub account of the cash source.

Paid Out Account- Use the drop down menu to map the cash source account in QuickBooks used for Paid Outs. This may be a "other expense" account or sub account of the cash source.

The account drop down menu function by default displays all account available in QuickBooks. However, this function can be configured to display certain account types by right clicking on the field and choosing a specific account type (i.e. bank or expense). This is convenient when configuring multiple data fields within the same programming session (typically occurs with initial installation)